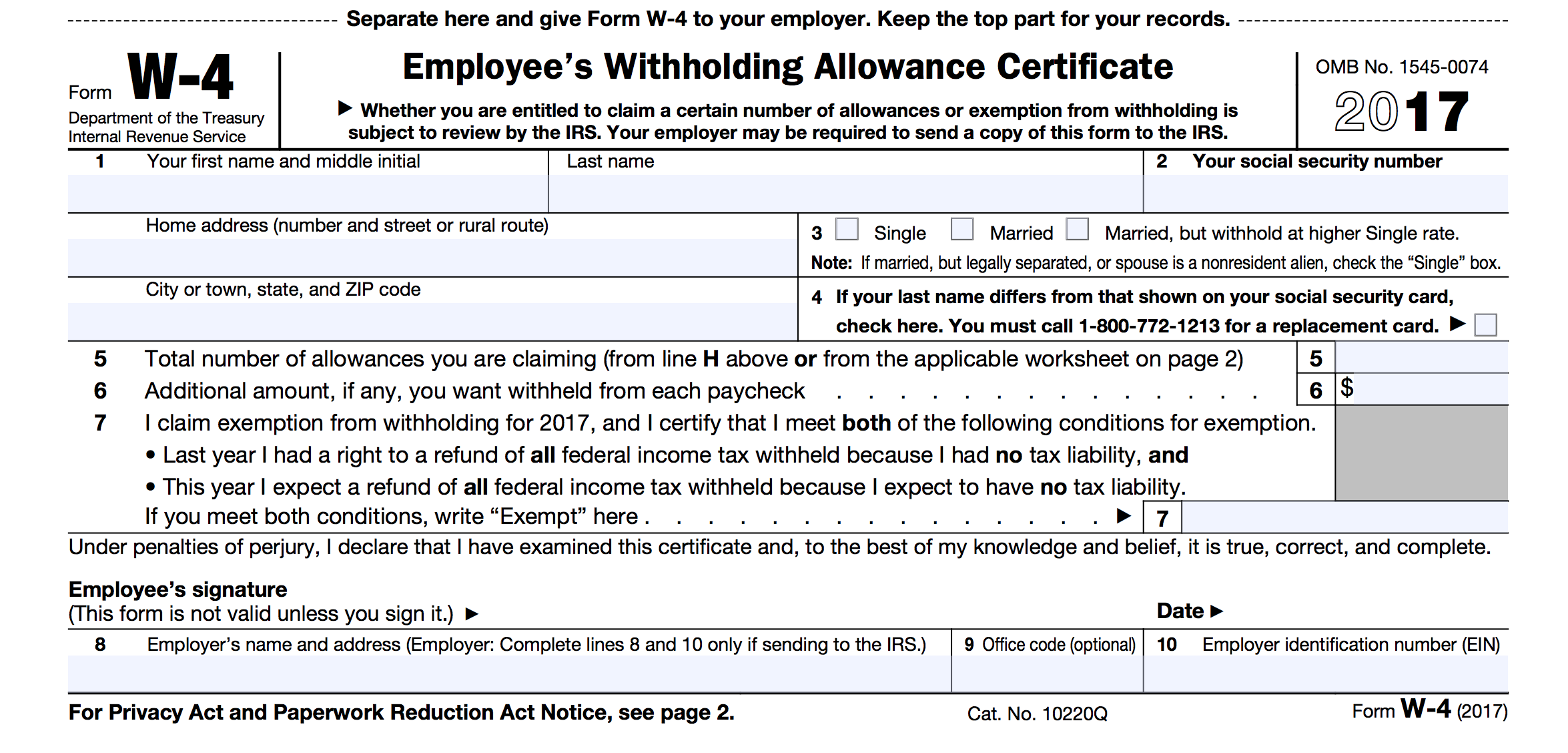

Looking to fill out your IRS Form W-4 for the year 2021? We’ve got you covered. With our user-friendly online platform, you can easily fill in, print, and submit your W-4 form in just a few simple steps. No more hassle of manually filling out complicated paper forms - our digital solution makes the process quick and painless.

2021 Form IRS W-4 Fill Online, Printable, Fillable, Blank

If you prefer a printable version of the IRS W-4 form, we have you covered. Simply click here to access the form. It is fillable and can be completed online before printing.

If you prefer a printable version of the IRS W-4 form, we have you covered. Simply click here to access the form. It is fillable and can be completed online before printing.

IRS Form W4 2022

If you are looking for the IRS Form W4 for the year 2022, you can find a printable version here. It is always recommended to consult the latest version of the form to ensure compliance with tax regulations.

If you are looking for the IRS Form W4 for the year 2022, you can find a printable version here. It is always recommended to consult the latest version of the form to ensure compliance with tax regulations.

W4 Form 2022 Printable, FAQ, How to Fill Out - Ultimate Guide

The W4 Form for the year 2022 is available in a printable format. For detailed guidance on how to fill out this form correctly, including frequently asked questions, consult our ultimate guide here.

The W4 Form for the year 2022 is available in a printable format. For detailed guidance on how to fill out this form correctly, including frequently asked questions, consult our ultimate guide here.

Printable W-4 Form For Employees 2021 - 2022

Are you an employer looking for a printable W-4 form for your employees? You can access the form here. Make sure your employees are up to date with their tax withholding information.

Are you an employer looking for a printable W-4 form for your employees? You can access the form here. Make sure your employees are up to date with their tax withholding information.

These are just a few of the resources available for filling out your W-4 forms. Remember to consult the official IRS website for the most accurate and up-to-date information. Ensure that you follow the instructions carefully and seek professional advice if needed. Making sure your W-4 form is accurately filled out will help avoid any potential issues with your tax withholdings and ensure a smooth tax filing process.

Disclaimer:

The information provided here is for informational purposes only and does not constitute legal or financial advice. The source of this data is not disclosed, and you should always consult with a qualified professional for guidance on your specific tax situation.